Exploring Reports in Scribe Accounts

Scribe Accounts offers a range of reports to suit your council's requirements. You may not need all of them, but it's recommended to view and explore each report to determine which ones best fit your needs.

How to Filter a Report

In most cases, you will need to define some parameters to filter the results such as:

- Selecting receipts, payments or both.

- Setting a starting point and finishing point for the data covered in the report. Some reports default to the start and end of the financial year, but you can change this as needed.

- Filtering the results by cost code or cost centre and setting the display order.

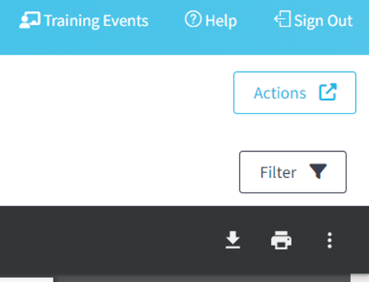

Using the Filter button above the report, you can select and amend the information you wish to view.

How to Download a Report

Once you have created your report you can download by simply selecting the Google ‘Download’ button, or by using the Actions button in the top right corner you can then choose the file format and the report will start downloading.

How to Print a Report

Once you have created your report you can print it by simply clicking the printer icon in the google print bar.

Recommended Reports

-

Transaction List: Use this report to produce a schedule of payments awaiting authorisation for approval at your Council meeting. You can also use this report to list all payments and receipts for a specific period to the Council.

-

Summary Report and Summary by Cost Centre: These reports provide a comparison between the annual budget and actual transactions for each code or cost centre. Use these to monitor your budget throughout the year, making note of any overspend/underspend and the reasons for this - this will assist with setting the budget for the next year as well as explanation of variances at year end.

-

Detailed Cost Centre: This report is helpful for a transaction level breakdown of spend/receipt against each cost code. It can also be monitored to ensure transactions have been allocated to the correct cost code and VAT rate.

- Reconcile All Banks: This report provides confirmation that all bank accounts balance with the data entered and reconciled within Scribe. We recommend completing reconciliations on a monthly basis - keeping on top of this will save you time at Year End.

-

Monthly Flexed Budget: This advanced report is useful when you're fully conversant with the rest of the system and if you find it necessary. It provides a comparison between the YTD (year-to-date) budget and actual transactions.

By exploring and utilising these reports, parish and town councils can effectively manage their financial records, monitor budget performance, and maintain transparency in their financial activities.

2 of 2 found this article helpful.