What is an Annual Return (I&E) within Town and Community Councils

The Annual Return, also know as the Accounting Statements, is a mandatory document that Town & Community Councils are required to complete at Year End as part of the Annual Governance Statement. The report includes specific categories such as Precept, Staff Costs, and Capital Repayments.

What is an Annual Return (I&E) within Scribe Accounts

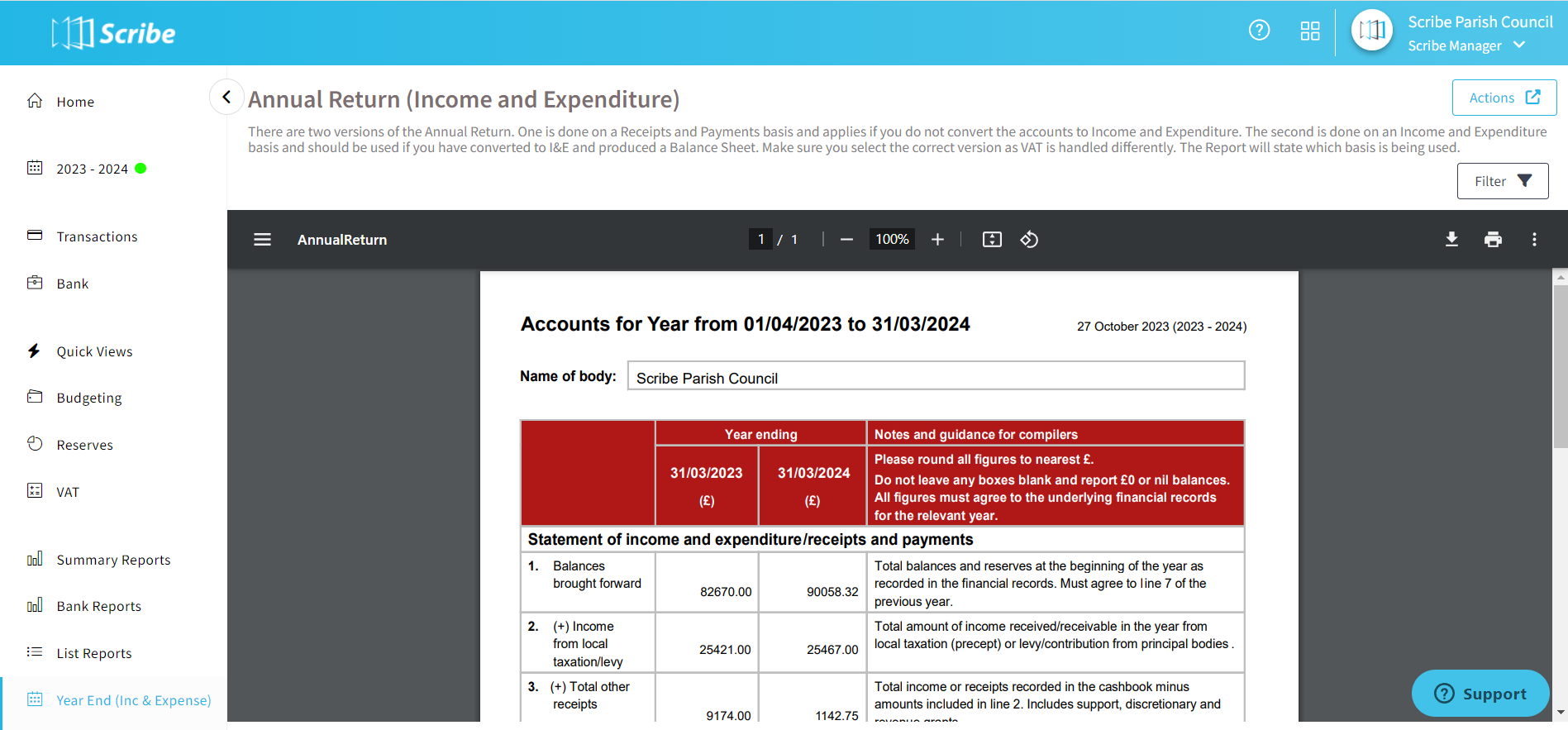

The Annual Return Report in Scribe produces the figures needed for Section 2 of the Annual Governance Statement. When working on an Income & Expenditure basis, the figures on the annual return will be net of VAT.

The report can be ran once all your data has been entered, the bank reconciliation completed as of 31st March, Year End Adjustments entered and the closing VAT position checked.

In order to get the correct figures into the correct lines on the return, you must identify which cost codes belong to each of the headings required by the report.

These are:

- Precept (Line 2)

- Staff costs (Line 4)

- Capital Repayments (Line 5)

This can be done when you set up the cost code by clicking on Capital Expenditure, Staff Costs or Precept under 'type' when you set up or edit the cost code - see here Cost Codes

Any other codes will be incorporated into the other receipts (Line 3) or other payments (Line 6) totals.

Where is the Annual Return (I&E) within Scribe Accounts

To access the Annual Return function, log into your Scribe Accounts and navigate to the menu Year End (Inc & Exp) → Annual Return.

How to Generate an Annual Return (I&E) within Scribe Accounts

Log into your Scribe Accounts and navigate to menu Year End (Inc & Exp) → Annual Return.

💡Ensure to run 'Calculate', which is the first menu option under Year End (I&E). This step is crucial to ensure all Year End reports within the I&E menu are using the latest figures.

The value entered into each box is explained below:

| 1 | Balances brought forward | Equals Box 7 from the previous year |

| 2 | Precept or Rates and Levies | Total amount of Precept received (plus rates and levies) |

| 3 | Total other receipts | Total of receipts less those relating to Boxes 2, 4 or 5 |

| 4 | Staff Costs | Net of payments and receipts coded to any codes identified as relating to Staff Costs |

| 5 | Loan interest/capital repayments | Net of payments and receipts coded to any codes identified as relating to Capital Repayments |

| 6 | All other payments | Total of payments less those relating to Boxes 2, 4 or 5 |

| 7 | Balances carried forward | Equal to Boxes (1+2+3) - (4+5+6) |

| 8 | Debtors and stock balances | Value of Debtors, Stocks/Stores, Prepayments as entered under Adjustments |

| 9 | Total value of cash and short-term investments | Box 7 less assets plus liabilities (as listed on the Balance Sheet) |

| 10 | Creditors | Value of Creditors, Accruals, Receipts in Advance as entered under Adjustments |

| 11 | Balances carried forward | Equal to Box 7 |

| 12 | Total fixed assets plus long-term investments and assets | Total as entered under Asset Register |

| 13 | Total borrowings | Total as entered under Borrowings |