What is Making Tax Digital (MTD)?

Making Tax Digital (MTD) is a UK government initiative to modernise the tax system by requiring businesses, individuals, and local councils to keep digital records and use software to submit their tax returns to HM Revenue and Customs (HMRC). The goal of MTD is to make it easier for taxpayers to keep accurate records and for HMRC to detect and prevent tax fraud and errors.

MTD applies to local councils that are VAT registered. It does not apply to those councils that are not VAT registered and claim back VAT using Form 126.

Making Tax Digital on Scribe

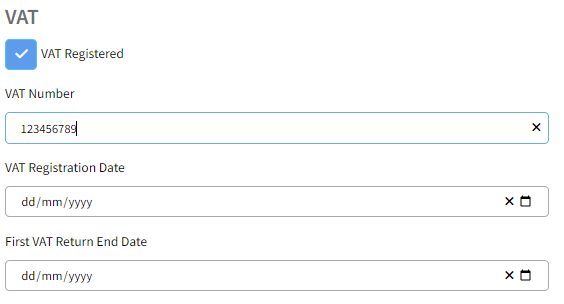

The Making Tax Digital menu option will appear if the VAT Registered box is ticked under Account → Council Profile, where you will need to enter your VAT registration details. Enter your VAT registration number (VRN) and your registration date. Once entered, click the 'Save' button at the bottom of the page.

Connecting to HMRC

Before you can link Scribe to your HMRC account for MTD you will need to be VAT registered. As Making Tax Digital is now mandatory you no longer need to sign up. If you have recently become VAT registered it can take a few days for HMRC to update their details so you will need to wait for this before commencing the next step.

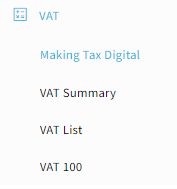

Navigate to VAT → Making Tax Digital:

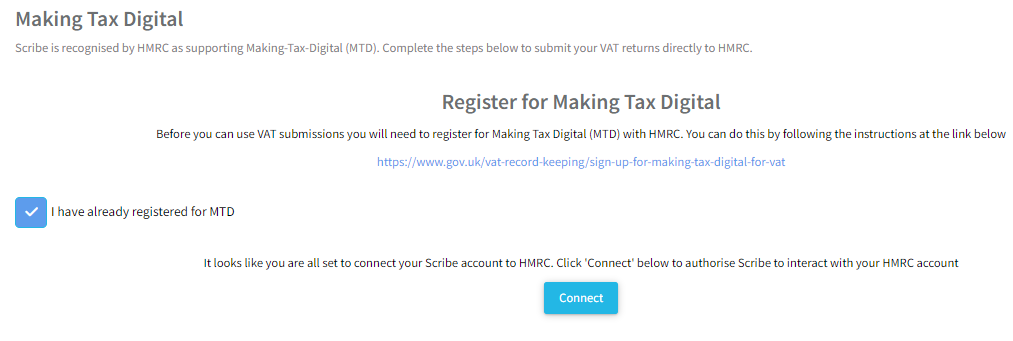

You will be presented with a screen checking that you have registered with HMRC for Making Tax Digital. As this is now mandatory this box can be ticked provided you are VAT registered. Click Connect.

All your data is transferred securely and access is granted using your Government Gateway ID. You will need to grant access to Scribe Accounts to view and submit VAT returns on your behalf.

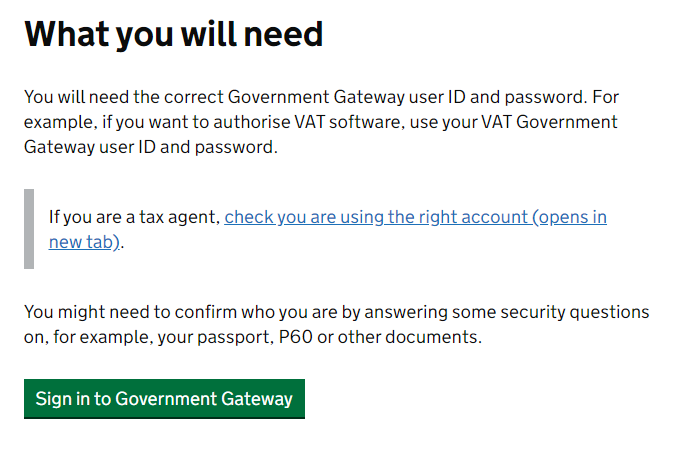

Click continue on the GOV.UK prompt that is displayed and sign in with your government gateway ID. You will need to ensure that the VRN that you entered on the Council Profile page is registered to this Government Gateway ID.

Next, read the Authority disclaimer and click Grant Authority to proceed.

💡 If you are unable to sign in using the link try logging into your Government Gateway account directly through the HMRC webpage. This will enable you to check that you are using the correct Government Gateway ID and password for your VAT account.

Once you have signed in successfully the menu will update. The Making Tax Digital option will be removed and replaced with the options listed below. The details shown on these pages come directly from your VAT account held with HMRC. For more details click on the links below:

0 of 0 found this article helpful.