HMRC Liabilities - Introduction

Managing outstanding liabilities is crucial for parish and town councils to maintain accurate financial records and ensure compliance. Scribe Accounts offers a convenient way to keep track of HMRC liabilities.

How to Manage HMRC Liabilities in Scribe Accounts

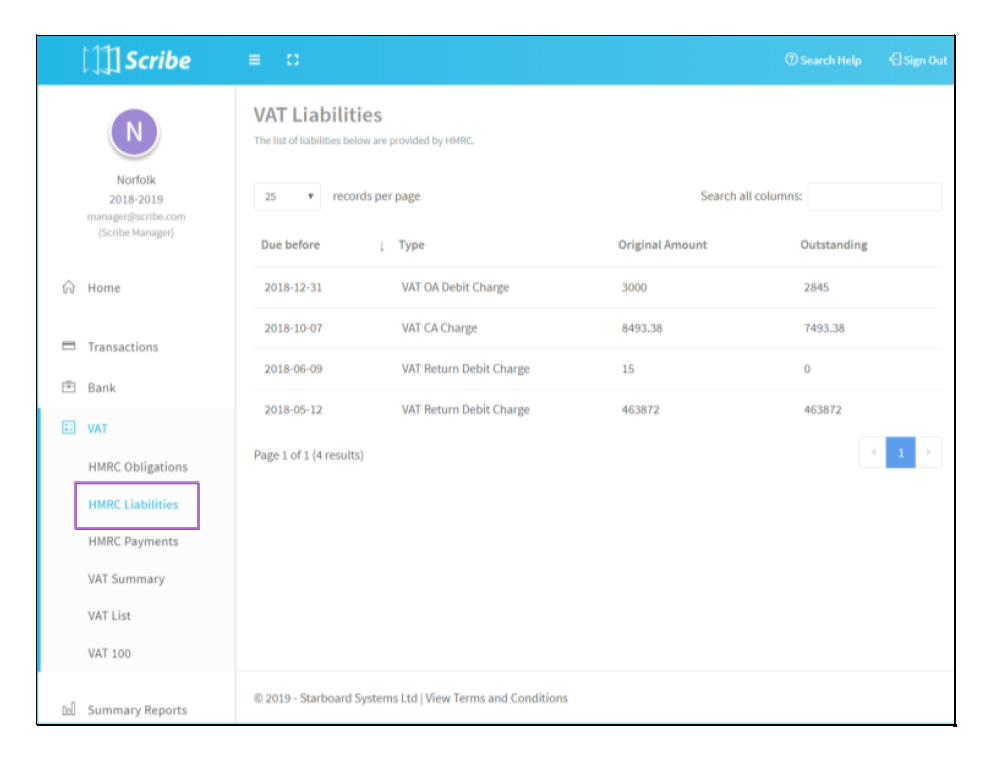

Navigate to the menu VAT → HMRC Liabilities

The Liabilities page displays details of any outstanding liabilities, allowing councils to easily identify and address them in a timely manner.

You should review the list of outstanding liabilities on the HMRC Liabilities page and determine the appropriate action to resolve each liability, such as making a payment to HMRC. Positive figures indicate you need to make a payment to HMRC, while negative values indicate HMRC must issue a VAT refund to you.

There are multiple ways in which to make payments to HMRC (e.g. Direct Debit, Bank Transfer). View this HMRC Webpage for further details including deadlines for each method.

Note, it is your responsibility to make the VAT payment to HMRC through one of the methods outlined on their website - Scribe simply links up with HMRC through MTD for the submission of the VAT return.

Complete the necessary actions and monitor the HMRC Liabilities page to confirm that the liabilities are no longer outstanding (e.g. showing "0" in the Outstanding column).

0 of 0 found this article helpful.