VAT Obligations - Introduction

Managing VAT obligations is an essential task for parish and town councils. Scribe Accounts simplifies this process by providing an easy-to-use interface for submitting VAT returns and monitoring outstanding obligations.

How to Manage VAT Obligations in Scribe Accounts

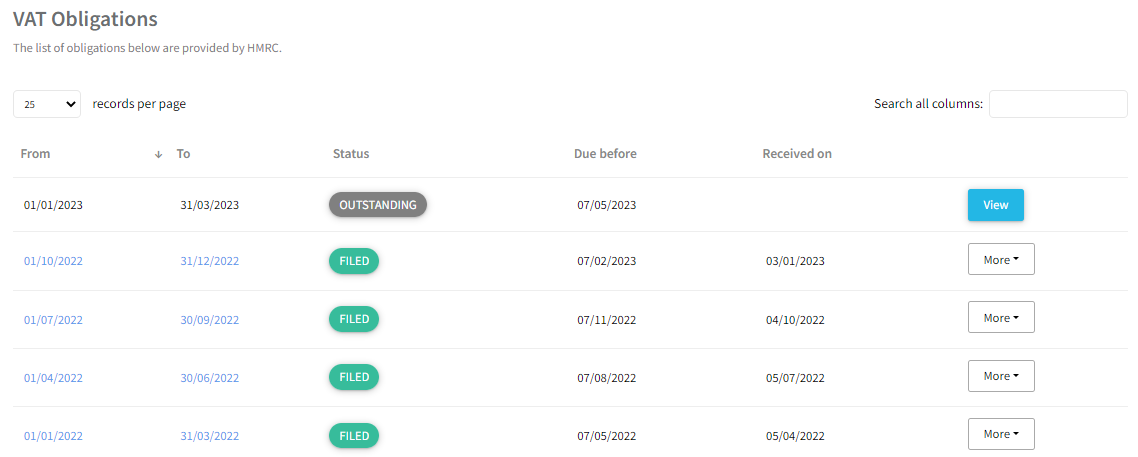

Navigate to the menu VAT → HMRC Obligations

Here you can view previous and upcoming submissions and their status (e.g. Filed, Outstanding). Outstanding VAT returns will show the due date and have a Submit button at the end of the row. If the obligation is overdue, the due date will be highlighted in red.

Submitting a VAT Return for an Outstanding Period

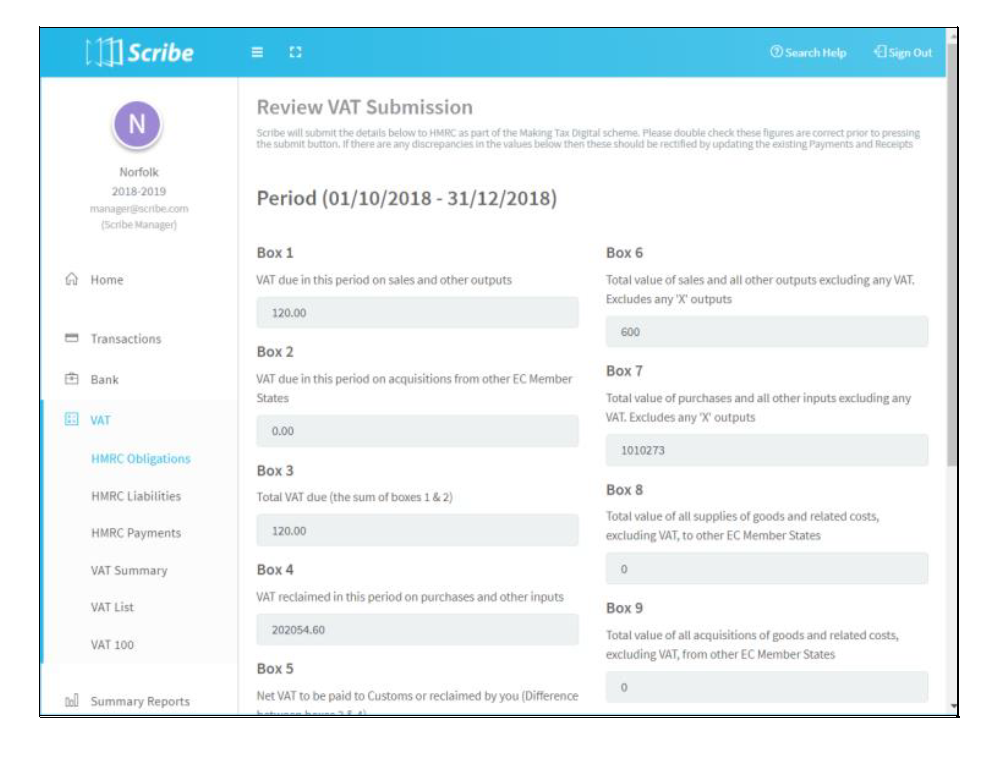

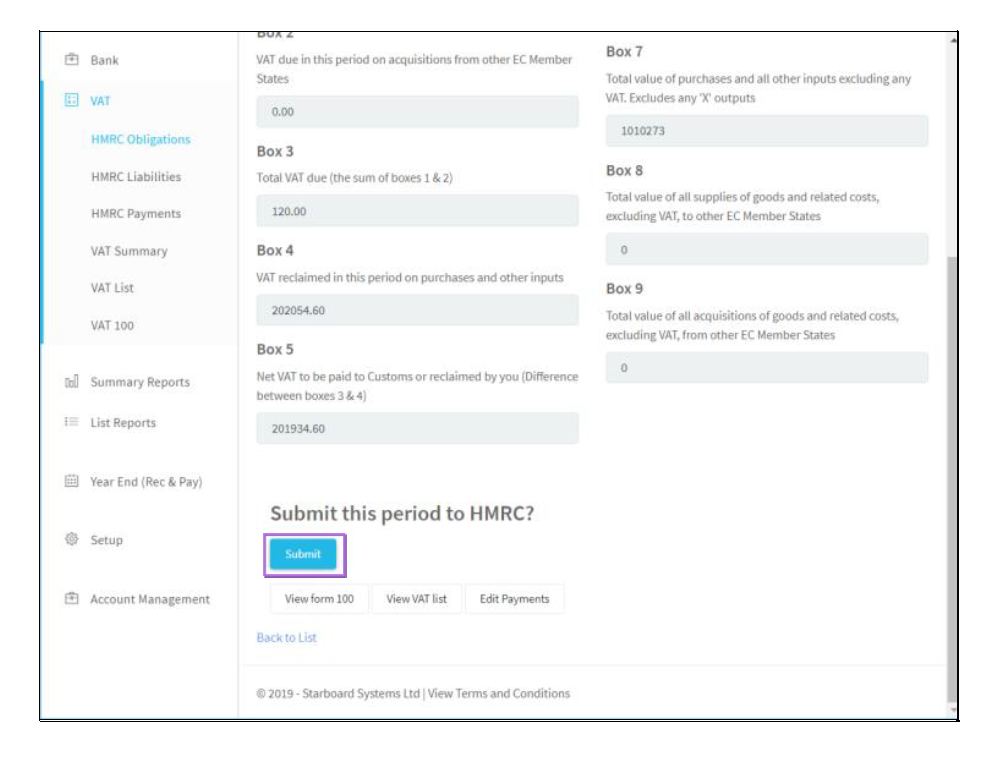

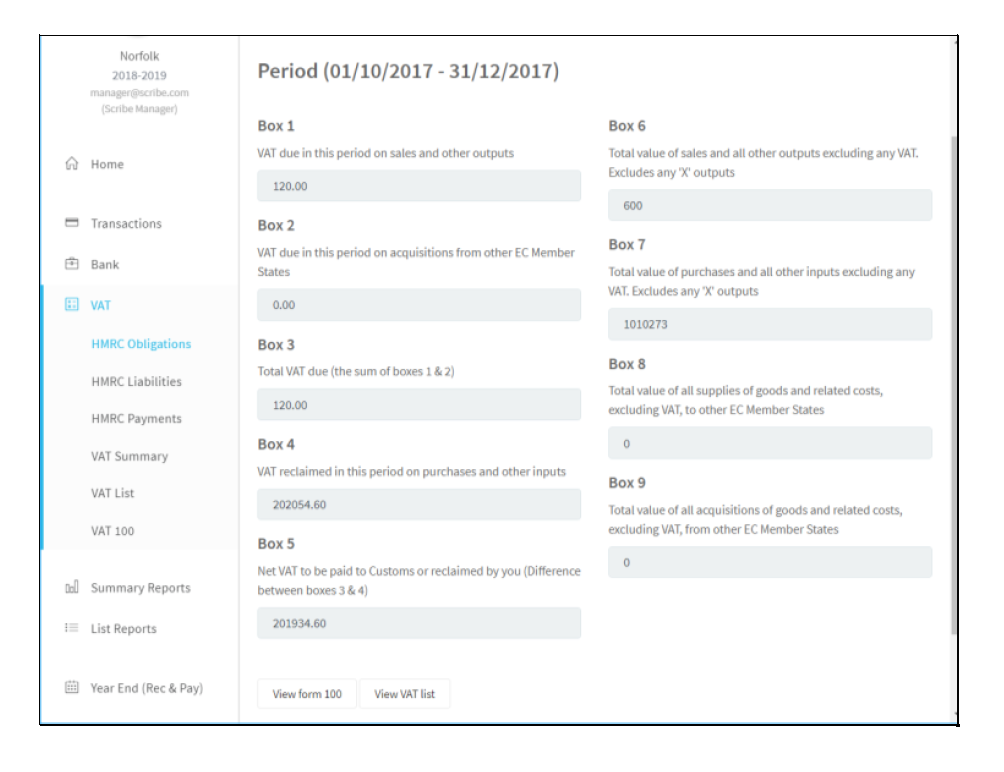

Click the Submit button for the outstanding VAT obligation you wish to address. Scribe will automatically calculate all figures using the records in the software, as per your VAT 100.

Ensure you have completed a bank reconciliation and that all bank accounts balance to the end of the VAT period before submitting. It's also a good idea to run your VAT List report beforehand to review transactions and the VAT type allocated.

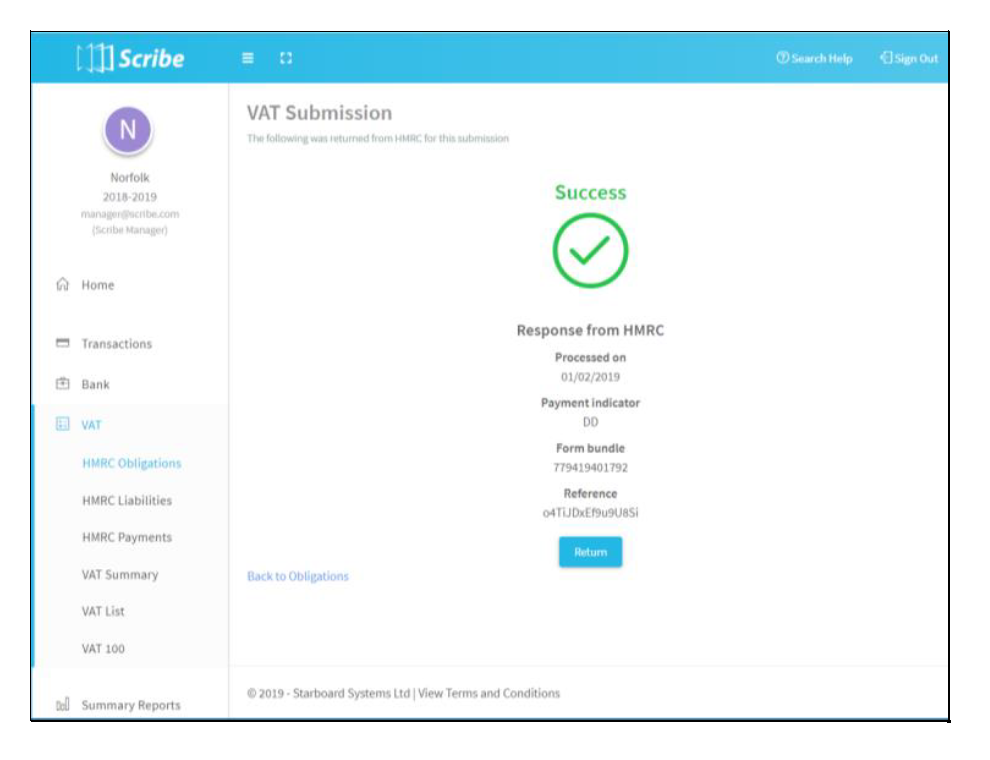

When satisfied with the figures, click the Submit button. Various details and reference numbers will be returned from HMRC upon submitting a return - store these for future reference.

Reviewing Previous Returns

Click on the period date or select More/View on each row of the obligation page.

Use this view to examine the numbers submitted as part of past VAT returns and explore the details of the return using the VAT list report.

1 of 1 found this article helpful.