HMRC Payments - Introduction

When submitting a VAT return through Making Tax Digital, you may be in a position where you need to make a VAT payment to HMRC. This will be the case if total VAT due on sales (Box 3) is higher than VAT to reclaim on purchases (Box 4). The VAT payment to be made to HMRC will be the Box 5 value on the VAT Return.

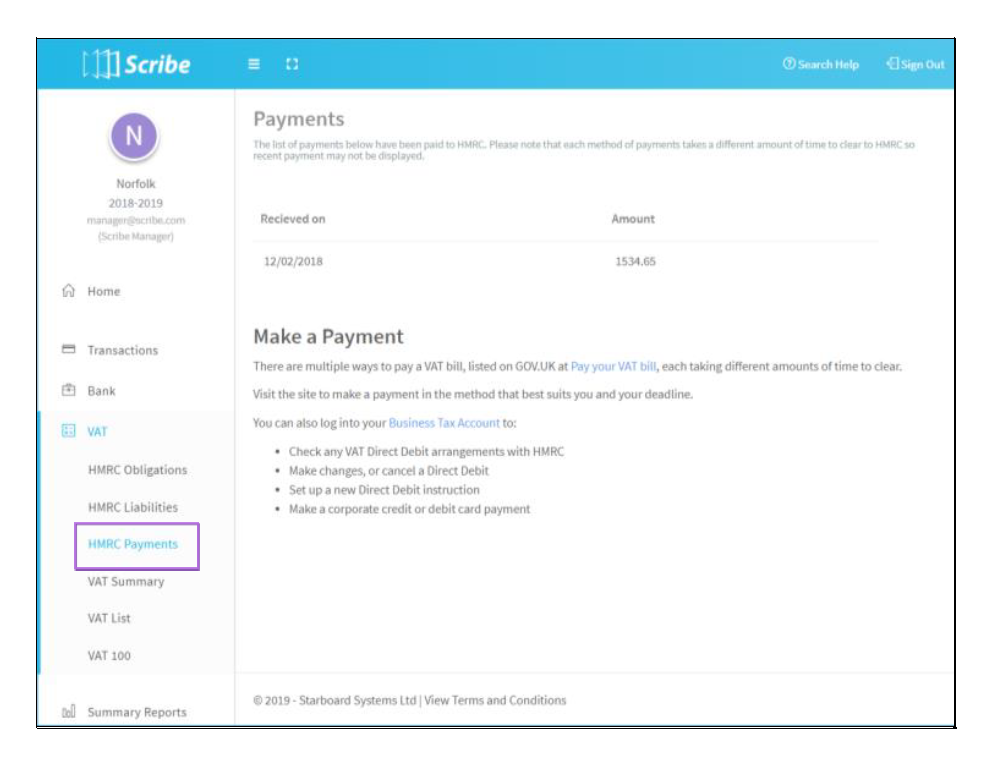

Keeping track of recent payments made to HMRC is essential for parish and town councils to maintain accurate financial records. Scribe Accounts provides a user-friendly interface to manage and monitor these payments.

How to View HMRC Payments in Scribe Accounts

Navigate to the menu VAT → HMRC Payments

This page displays a list of recent payments made to HMRC, allowing councils to easily review their payment history. Note, only payments that have been received by HMRC will appear in this list.

There are multiple ways in which to make payments to HMRC (e.g. Direct Debit, Bank Transfer). View this HMRC Webpage for further details including deadlines for each method.

Note, it is your responsibility to make the VAT payment to HMRC through one of the methods outlined on their website - Scribe simply links up with HMRC through MTD for the submission of the VAT return.

1 of 1 found this article helpful.