Last edited:

Explore other guides in this series:

- Payment Integration - Setting up Stripe

- Payment Integration - Adding Stripe to Scribe

- Payment Integration - Accepting Online Payments

- Payment Integration - Reconciling Stripe Payouts

- Payment Integration - Stripe Metadata

When customers pay invoices via Stripe, the payment is instantly marked as paid and converted to a receipt in Scribe Accounts. Stripe payouts are then typically received 5-7 days later into the receiving bank account.

We recommend creating a separate "Stripe" bank account within Scribe for the recording of payments paid via Stripe. Please see Payment Integration - Setting Up Stripe. This means a bank transfer record must be created for each payout, from the Stripe bank account to the receiving bank account.

To ensure your Stripe transactions are correctly reconciled in Scribe, follow these steps:

Steps to Reconcile Stripe Payouts

Step 1: Access Your Stripe Account

- Log in to your Stripe account at https://dashboard.stripe.com/login. This is separate to your Scribe account.

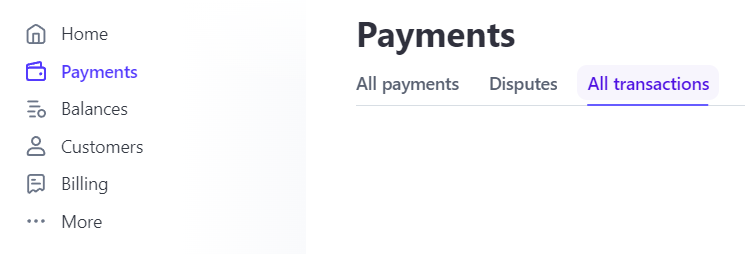

- Navigate to Payments → All Transactions. This acts as your bank statement and provides a list view of individual payments and corresponding payouts.

Step 2: Identify Stripe Payouts & Record Bank Transfer

- Stripe payouts are made on a daily basis where there is a balance available. Each payout will be recorded in Stripe with a date and total amount - this will match the receiving accounts bank statement.

- You can match individual payments to payouts based on this date. For example, a payment that is made available in Stripe on 5th March will be included in the payout on 5th March. If multiple payments are made in the same day, these will be grouped together to form the one payout.

- A bank transfer must be created for each payout, from the Stripe bank account to the receiving bank account.

Step 3: Reconciling the Stripe Bank Account in Scribe

- Navigate to Bank → Reconcile in Scribe Accounts.

- Select your Stripe bank account from the drop-down and enter the payout date as the cashed date.

- Transactions shown in the reconciliation screen will include the invoice numbers and these are also detailed on the Stripe transactions list for easy reconciling. You will need to reconcile the relevant receipts, payments (transaction fees), and the corresponding bank transfer.

- Ensure that the final balance is £0.00. The receipt and payment transactions netted off should always equal the payout received, therefore your Stripe bank account should always be £0.00 (similar to a credit card).

Step 4: Reconciling the Receiving Bank Account in Scribe

- Navigate to Bank → Reconcile in Scribe Accounts.

- Select your bank account from the drop-down and use the end of the month as the cashed date (or the end date on your bank statement) as usual.

- Reconcile the other half of the bank transfer for the Stripe payout. Each transfer should match the payout shown on your bank statement.

Additional Tips

- Invoice Payments: If a Stripe link was used to pay an invoice, the invoice number will appear in the Stripe transaction list. Use this for easy matching in Scribe.

- Online Booking Payments: If a booking was paid online before an invoice was raised, the booking reference will be provided in the Stripe transaction list.

By following these steps, you can ensure that your Stripe payouts are accurately reconciled in Scribe Accounts, keeping your financial records up-to-date and in order.

0 of 1 found this article helpful.