What is the Reconcile Box 7 and 8 Report within Parish and Town Councils

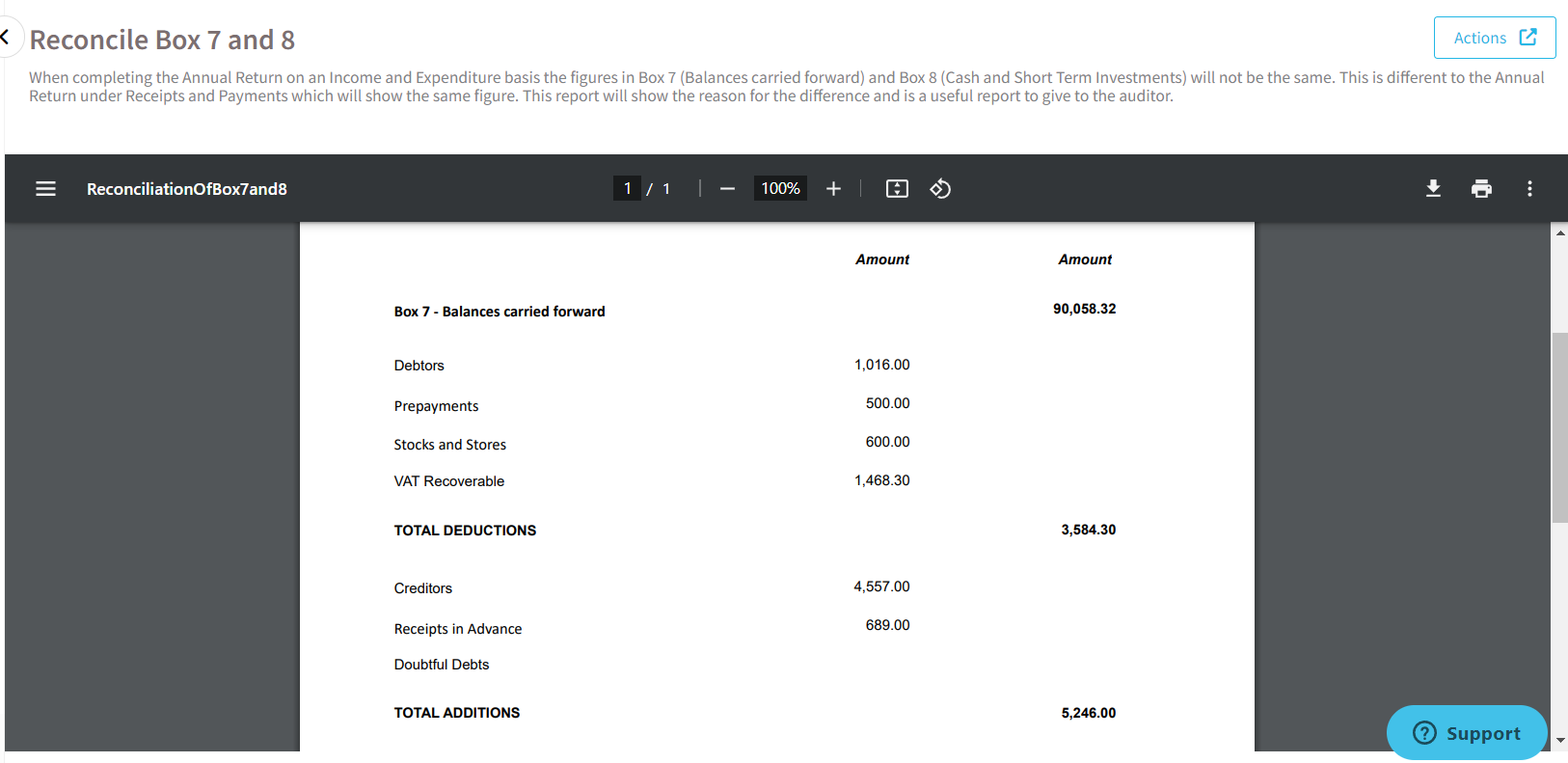

The reconciliation process between Box 7 and Box 8 is a key financial document for Councils working in Income & Expenditure at year end, as it shows the adjustments needed to align the 'Balances carried forward' (Box 7) with 'Cash and Short Term Investments' (Box 8).

What is the Reconcile Box 7 and 8 Report within Scribe Accounts

Within Scribe Accounts, the Reconcile Box 7 & 8 report explains the difference between the total balance in Box 7 and the cash balance in Box 8 by showing the totals for each type of adjustment. It deducts the assets which have been included on the balance sheet and adds back in the liabilities from Box 7 (Balances Carried Forward) to arrive at Box 8 (Cash and short term investments). This only applies to Councils completing Year End on an Income and Expenditure basis.

Where is the Reconcile Box 7 & 8 Report within Scribe Accounts

Log into Scribe Accounts and navigate to menu Year End → Reconcile Box 7 & 8

Before running the report, ensure you run Calculate to account for all the adjustments you have entered.

- The report will show a total for each type of adjustment - a breakdown of adjustments entered and further details can be viewed using the Adjustments report.

- Scribe will automatically calculate the closing VAT position at Year End - you do not need to enter this. The figure will be taken from the VAT Summary and will form a debtor or creditor.

How to Download the Reconcile Box 7 & 8 Report

You can download the report by simply selecting the Google ‘Download’ button, or by using the Actions button in the top right corner you can then choose the file format and the report will start downloading.

.

How to Print the Reconcile Box 7 & 8 Report

Once you have created your report you can print it by simply clicking the printer icon in the google print bar.

0 of 0 found this article helpful.