What is the Annual Return (Rec & Pay) Report within Parish and Town Councils

The Annual Return, also know as the Accounting Statements, is a mandatory document that Parish & Town Councils are required to complete at Year End as part of the Annual Governance and Accountability Return (AGAR). The report includes specific categories such as Precept, Staff Costs, and Capital Repayments.

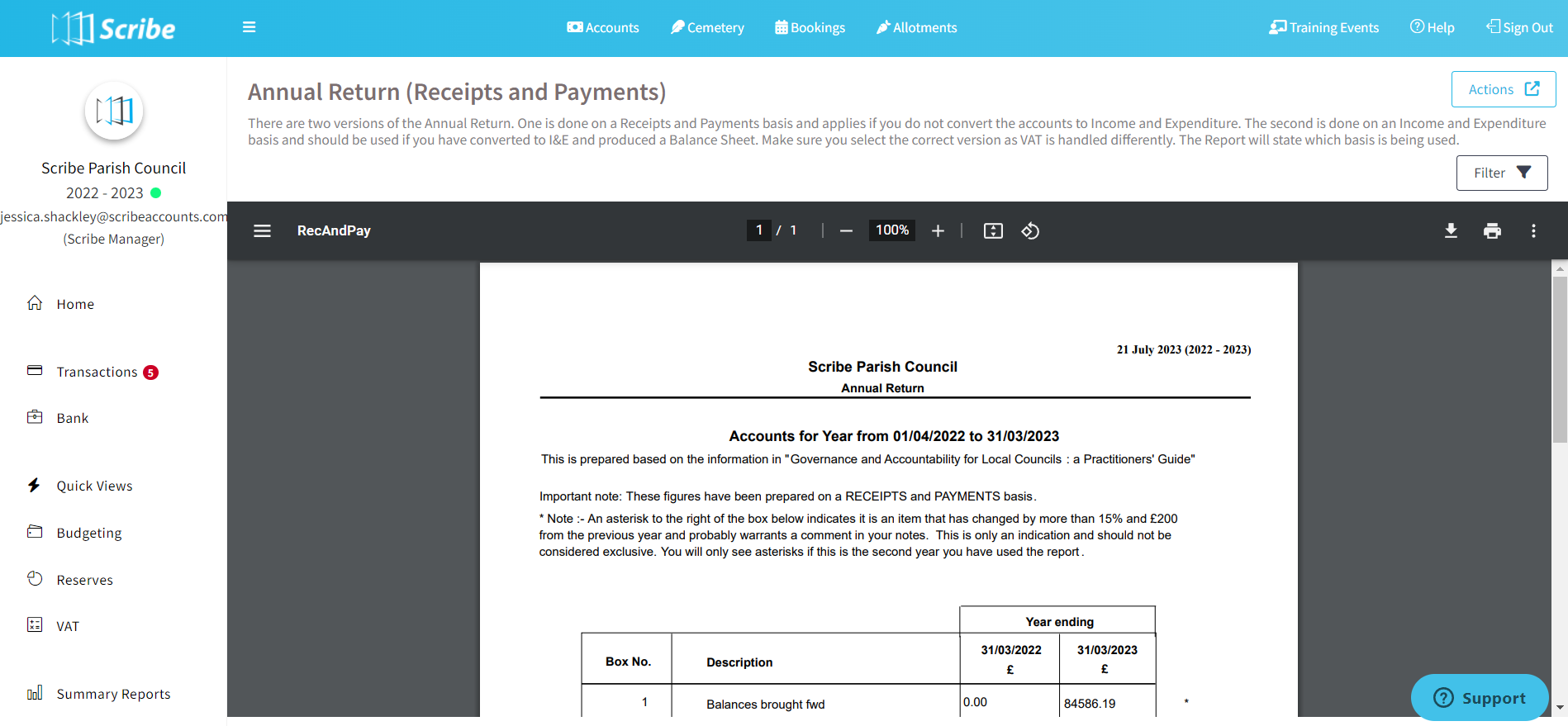

What is the Annual Return (Rec & Pay) Report within Scribe Accounts

The Annual Return Report in Scribe produces the figures needed for Section 2 of the AGAR: The Accounting Statements. When working on a Receipts & Payments basis, the figures on the annual return will be gross.

The report can be ran once all your data has been entered and the bank reconciliation completed as of 31st March.

In order to get the correct figures into the correct lines on the return, you must identify which cost codes belong to each of the headings required by the report.

These are:

- Precept (Line 2)

- Staff costs (Line 4)

- Capital Repayments (Line 5)

This can be done when you set up the cost code by clicking on Capital Expenditure, Staff Costs or Precept under 'type' when you set up or edit the cost code - see here Cost Codes

Any other codes will be incorporated into the other receipts (Line 3) or other payments (Line 6) totals.

Where is the Annual Return (Rec & Pay) Report within Scribe Accounts

To access the Annual Return Report, log into your Scribe Accounts and navigate to menu Year End (Rec & Pay) → Annual Return.

How To Generate An Annual Return (Rec & Pay) Report Within Scribe Accounts

Log into your Scribe Accounts and navigate to menu Year End (Rec & Pay) → Annual Return.

The value entered into each box is explained below:

| 1 | Balances brought forward | Equals Box 7 from the previous year |

| 2 | Precept or Rates and Levies | Total amount of Precept received (plus rates and levies) |

| 3 | Total other receipts | Total of receipts less those relating to Boxes 2, 4 or 5 |

| 4 | Staff Costs | Net of payments and receipts coded to any codes identified as relating to Staff Costs |

| 5 | Loan interest/capital repayments | Net of payments and receipts coded to any codes identified as relating to Capital Repayments |

| 6 | All other payments | Total of payments less those relating to Boxes 2, 4 or 5 |

| 7 | Balances carried forward | Equal to Boxes (1+2+3) - (4+5+6) |

| 8 | Total value of cash and short-term investments | Equal to Box 7 (Receipts and Payments only) |

| 9 | Total fixed assets plus long-term investments and assets | Total as entered under Asset Register |

| 10 | Total borrowings | Total as entered under Borrowings |

How to Filter an Annual Return Report

Before you generate your report using the above steps click the ‘Filter’ button. You can then access additional filter options such as selecting to view a breakdown of boxes 3, 4, 5 & 6, as well as removing the pence to give rounded figures on the Annual Return.

How to Download an Annual Return Report

Once you have created your report you can download by simply selecting the Google ‘Download’ button, or by using the Actions button in the top right corner you can then choose the file format and the report will start downloading.

How to Print an Annual Return Report

Once you have created your report you can print it by simply clicking the printer icon in the google print bar.

0 of 0 found this article helpful.