What is a Trial Balance within Parish and Town Councils

A trial balance is a fundamental accounting report that lists the balances of all ledger accounts at a particular point in time, typically at the end of an accounting period. The primary purpose of a trial balance is to ensure that the total debits equal the total credits which helps in verifying the mathematical accuracy of the bookkeeping processes.

In a trial balance, accounts are usually listed with their names and respective balances. Debit balances are entered in one column, while credit balances are entered in another. The total of the debit column should match the total of the credit column, indicating that the accounts are in balance. This balance is crucial because it forms the basis for preparing the financial statements, such as the income statement and balance sheet.

The trial balance aids in the detection of errors in the accounting entries. However, it's important to note that while a trial balance can help identify mathematical errors, it cannot guarantee the complete accuracy of the accounts. There are certain types of errors, such as omitting a transaction entirely or recording a transaction in the wrong account, that a trial balance cannot uncover.

What is a Trial Balance within Scribe Accounts

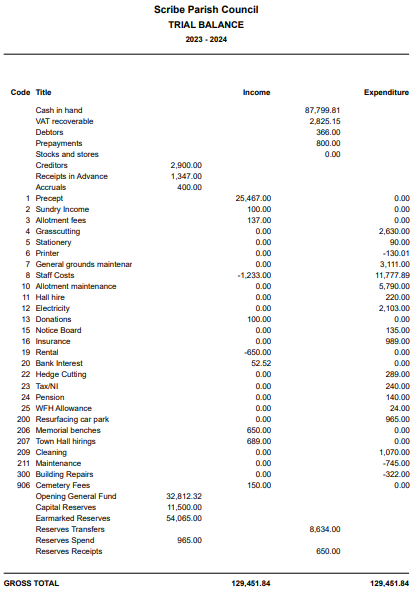

In Scribe Accounts, the Trial Balance lists the balances as at 31st March. The balance sheet items are listed first followed by the cost codes totals. The amount against each cost code is the income and expenditure figure, e.g. taking account of any adjustments entered. Finally the reserves balances are listed showing the opening general fund and the balances as per the reserves balance report.

As Scribe does not use a formal double-entry system the balances are not listed under Debit and Credit headings. Instead Income and Expenditure headings are used to be consistent with other Year End reports. These columns show the amounts against each cost code with the other items listed in the corresponding column.

The total of the first two columns is shown under the Income heading and the second two columns are totaled under Expenditure. The totals should match. If they are not a red error message will be displayed. See separate helpguide on how to correct.

Where is the Trial Balance within Scribe Accounts

To access the Trial Balance report, log into your Scribe Accounts and navigate to the menu Year End (I&E) → Trial Balance

This will open the Trial Balance. Be sure to run Calculate before generating this report to ensure that all necessary entries are considered.

How to Download a Trial Balance Report

You can download the report by simply selecting the Google ‘Download’ button, or by using the Actions button in the top right corner you can then choose the file format and the report will start downloading.

.

How to Print a Trial Balance Report

Once you have created your report you can print it by simply clicking the printer icon in the google print bar.

0 of 0 found this article helpful.