What is the Purpose of the VAT List

The purpose of the VAT List for parish and town councils is to provide detailed information on the transactions within the relevant period, allowing for a thorough backup and cross-check of the VAT return. This report is crucial for parish and town councils to ensure accurate VAT reporting and to maintain compliance with HMRC requirements.

How to Generate a VAT List

Log into Scribe Accounts and navigate to the menu VAT → VAT List. The report will automatically load showing all transactions for Quarter 1.

How to Filter a VAT List

Click Filter on the right hand side above the report screen to view the available filter options:

- Date Range: select a Quarter (based on standard quarter dates starting 1st April), Financial Year (from 1st April to today) or Custom date range if you would like to enter your own date range.

- VAT: defaults to All but alternatively select a specific VAT type or 'Exclude zero rated' to only transactions with a VAT amount.

- Order By: select whether to list the transactions in Voucher Date or Voucher Number order.

How to Download or Share the VAT List

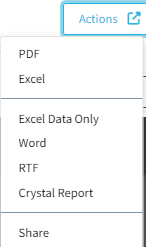

The report can be downloaded by simply clicking 'Actions' in the top corner of the screen. The following download options will be listed, PDF or Excel being the most commonly used. Click your chosen option and the report will be created.

Clicking Share will create a link that when clicked opens the report PDF in a separate webpage.

How to Print the VAT List

Generate the VAT List as described in the first section. Once the report is generated, click the printer icon in the top right corner of the report page. Follow the prompts in the print dialogue box to adjust settings and print the report.

💡 Note on VAT Types: For the VAT reports to work effectively, VAT types need to be carefully defined. See VAT Rates for further details.

0 of 0 found this article helpful.