VAT Types - An Introduction

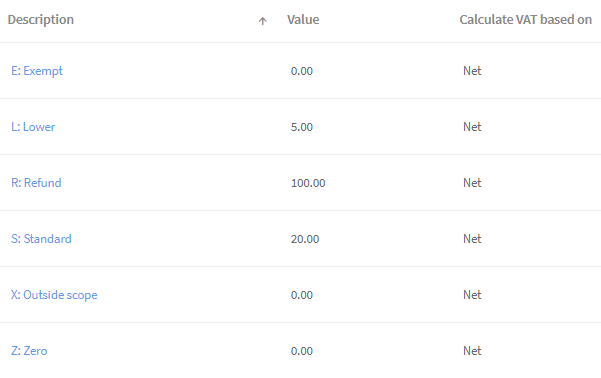

Your Scribe account will be populated with a default set of VAT types. Navigate to menu Setup →VAT Types to view them - the VAT types and percentage set against them will be listed.

Which VAT Type Should I use?

- E: Exempt - calculates zero VAT. Used for anything categorised as such, e.g. stamps, subscriptions.

- L: Lower - calculates 5% VAT. Generally used for utilities.

- R: Refund - used only for the receipt entry of a VAT refund received from HMRC, or for the payment entry of a VAT payment made to HMRC.

- S: Standard - calculates 20% VAT. Used for VAT registered suppliers clearly showing their VAT Number and the amount/rate of VAT being charged on the invoice.

- X: Outside Scope - calculates zero VAT. Used for the precept, salaries and any supplier not registered for VAT.

- Z: Zero - calculates zero VAT. Used for anything categorised as such, e.g. books.

- C: Reverse Charge VAT - only relevant for VAT registered councils for invoices stating the VAT is subject to the Reverse Charge. Click here for more details.

Adding VAT rates

Adding or amending VAT types should not be required as the default types provided should cover the majority of scenarios. Please contact us if you believe you require an additional VAT type.

VAT Type: Reverse Charge

The Reverse Charge is a mechanism for dealing with VAT where it becomes the customer's responsibility to account for VAT by showing it as both input and output tax on the VAT Return. The Reverse Charge is currently used in two specific areas - construction and electronic applications, e.g. Zoom or Dropbox.

The Reverse Charge only applies to councils that are VAT registered because of the way in which it is dealt with, i.e. recording it on the VAT Return. Therefore, councils that are not VAT registered (and just claim back VAT using Form 126) will not see this VAT type available in their account and nor do they need to record the reverse charge VAT element.

If you receive an invoice that states the VAT is subject to the Reverse Charge and your council is VAT registered (i.e. the VAT Registered box is ticked under Account/Council Profile) you will need to add this VAT type to your account:

- Navigate to menu Setup →VAT Types

- Click Add VAT type for Reverse Charge in the top right corner of the screen:

- C: Reverse Charge 20% will then show in the list of available VAT types (C is used here as R is already used for the VAT type R: Refund).

A payment transaction can then be added for the Reverse Charge invoice:

- Enter all the details in the normal way, ensuring C: Reverse Charge 20% is selected under VAT Type:

- At this point no VAT will be shown - this is correct as the amount of the invoice itself, and what is to be paid to the supplier should be recorded here. The VAT element will be dealt with on the VAT return and viewable on the VAT reports only.

The VAT Return (VAT100 or Making Tax Digital)

- The Reverse Charge requires the VAT element to be recorded in both Boxes 1 and 4 and the total net value of the invoice to show in Boxes 6 and 7. By using the C: Reverse Charge 20% VAT type these boxes are automatically updated:

- At the bottom of the VAT Return report additional details are given if any Reverse Charge invoices are included.:

The VAT List

- This report shows the details of all transactions entered on to Scribe, along with the VAT type recorded. It is useful if you require more details on the transactions feeding into the VAT Return, for example those entered with the VAT Type C: Reverse Charge 20%:

0 of 0 found this article helpful.