Last edited:

Why do VAT refunds received not show on the Summary Report?

The Summary Report in Scribe compares actuals vs budgets based on net figures. This is because any VAT paid throughout the year will simply be reclaimed, and therefore is not a true cost to the council.

If VAT refunds have been entered correctly with VAT type R: Refund, then the receipt will be recorded wholly at VAT with no net value, hence they will not appear on your Summary Report against a budget.

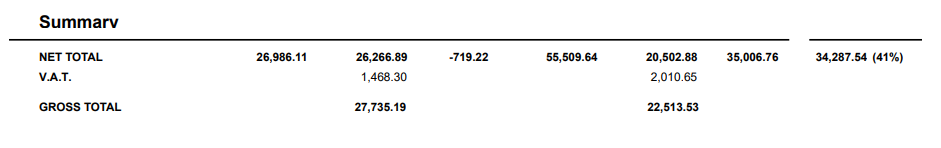

However, you can still find the impact of these VAT refunds in the report. The total amount of VAT refunds received (as well as VAT paid) will be included within the total figures at the bottom of the Summary Report. This will be reflected as a reduction in the VAT recoverable balance.

Remember, the purpose of the Summary Report is to provide an overview of your net income and expenditure, rather than detailing individual transactions. For more detailed information on specific transactions, you can view the Transactions List report for the Detailed Cost Centre report.

6 of 6 found this article helpful.