▶ How do I record VAT returns amounts from HMRC when interest is added or deducted?

Created by: Hannah Driver

Last edited:

Last edited:

How do I record VAT Return amounts from/paid to HMRC when Interest is Added or Deducted?

When handling VAT returns where HMRC either pays interest or deducts it due to an outstanding balance, it's important to ensure that your records in Scribe Accounts accurately reflect these transactions in order that the VAT position can calculate correctly. Below is a step-by-step guide on how to manage these entries correctly.

Checking the Amounts owing to/paid by HMRC

To check the amount that will be received from or is owed to HMRC:

- Navigate to VAT → VAT Liabilities

- The VAT Return Box 5 figure will be listed. The description 'Credit Charge' denotes VAT that will be repaid to the council. If the description states' Debit Charge' then VAT is owed to HMRC.

- If VAT interest is to be paid or deducted from the amount received a separate line will be shown. 'VAT Interest Repayments' are interest amounts that HMRC will pay in addition to the Box 5 total.

- 'VAT Interest' and 'TG PEN' are amounts owed to HMRC. Where possible this will be deducted from the amount paid to the council. If the council owes HMRC it may be necessary to check if additional amounts need to be paid.

Recording Interest Received in Addition to the Box 5 figure from HMRC

- Navigate to Transactions → Receipts.

- Click the Add button to create a new receipt.

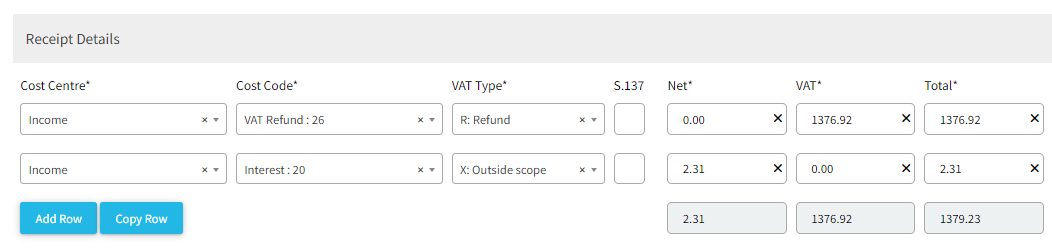

- Enter a line equal to the Box 5 figure of the VAT return, ensuring the VAT Type R: Refund is used.

- Enter another line for the additional interest received (the interest amount can be checked by going to VAT → VAT Liabilities) using the VAT Type X: Outside Scope.

- Fill out any remaining fields as required and save the receipt, ensuring that the total matches to the amount received from HMRC.

Recording Interest Deducted from the Box 5 figure paid from HMRC

Step 1: Record the VAT Box 5 figure as a Receipt

- Navigate to Transactions → Receipts.

- Click the Add button to create a new receipt.

- Enter the total VAT refund amount from Box 5 of the VAT return in the amount field, regardless of the deduction.

- Select the VAT Type "R: Refund".

- Complete the necessary details and save the receipt.

Step 2: Record the Interest Deducted as a Payment

- Navigate to Transactions → Payments.

- Click the Add button to create a new payment entry.

- Enter the amount of interest deducted by HMRC in the amount field.

- Since this is an interest payment, use a relevant description to indicate it's an interest deduction.

- Save the payment entry.

Step 3: Verify the Net Amount

- Ensure the receipt less the payment equals the actual net amount received from HMRC. This will reflect the total amount of the VAT refund reduced by the interest deduction.

- When completing the bank reconciliation the amount received from HMRC will match to both the receipt and the payment entry so ensure both entries are ticked off.

Recording Interest/Penalties paid in addition to the Box 5 figure

If interest amounts or penalties (the amounts can be checked by going to VAT → VAT Liabilities) are owed to HMRC you may be required to pay these in addition to the Box 5 figure on the return. This should be recorded in the following way:

- Navigate to Transactions → Payments

- Click the Add button to create a new payment,

- Enter a line equal to the Box 5 figure of the VAT return, ensuring the VAT Type R: Refund is used.

- Enter another line for the additional interest or penalties using the VAT Type X: Outside Scope.

- Fill out any remaining fields as required and save the payment, ensuring that the total matches to the amount paid to HMRC.

Did you find this article helpful?

0 of 0 found this article helpful.

0 of 0 found this article helpful.

Can't find what you're looking for?Log a ticket