Last edited:

What is the Trial Balance?

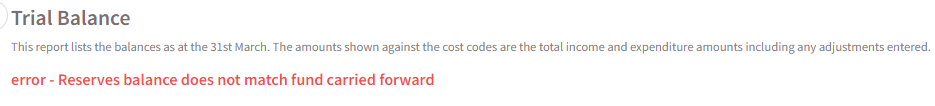

The Trial Balance is a report appearing under the Year End menu for Income & Expenditure users. It lists the balances as at 31st March, taking into account any adjustments entered. The totals at the bottom of the report should be equal. If they are not then a red error message may be shown. The reasons for the error messages and the Trial Balance not balancing and how to correct are dealt with below.

Has Calculate been run?

Before running any Year End (I&E) report Calculate should be run to update for the latest figures. If you have not run Calculate before viewing the Trial Balance report please do so to see if it resolves the error.

Red Error - Reserves balance does not match fund carried forward

This error will appear if you are still using the original version of Reserves on Scribe as the Trial Balance is configured for the new version. This means that the reserves transfers will not show on the Trial Balance report and will constitute the difference between the two columns.

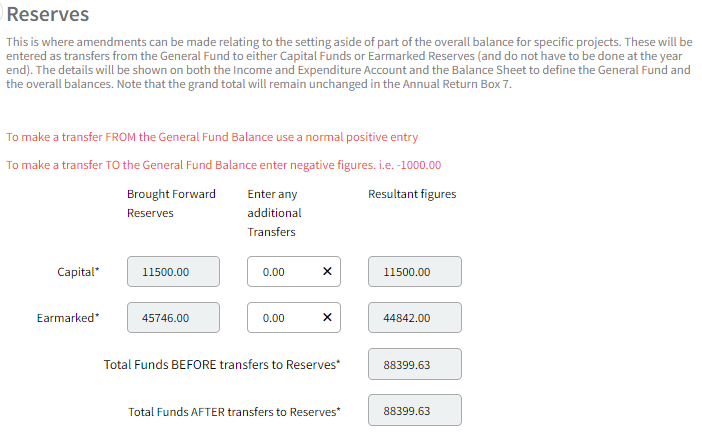

If you have a reserves menu option appearing only under Year End (I&E) then you are using the original version which will display the following page:

The original version is basic and requires users to manually calculate their Reserves position outside of Scribe with a single entry for each the total capital and earmarked amounts to update at year end. The new version is much more comprehensive and allows the linking of cost codes to reserves so that reserves balances are automatically updated meaning better management and reporting on Scribe.

How do I resolve the error?

There are two approaches to resolving this error:

- If you would like to continue using the original version of reserves the reserves transfers that you enter will not be picked up on the Trial Balance report meaning it will be out by the value of the transfers. Therefore if you want to produce a balancing Trial Balance you must download it into Excel and add in the transfer total manually. Go to Actions to download the report and remember that when it is downloaded the formulas are dropped so you must recalculate the totals.

- Move to the new version of Reserves as any reserves transfers will automatically appear on the Trial Balance. The new version allows much more comprehensive management of reserves in Scribe but can take some setting up so do consider if it may be preferable to do this from the new financial year. If this is the case you will need to manually update the trial balance report for the current year as above.

The column totals do not match but no error message is shown

This error will appear if year end adjustments entered in the previous year were allocated to codes that do not exist in the current year. This may be because the code structure was reset in the current year or if codes have been deleted in the new year. When changing the cost code structure it is very important to be mindful of the impact any updates/changes may have.

How do I know which codes are causing the issue?

- Firstly, work out the value of the difference on the Trial Balance by deducting one column total from the other. This is the amount of the adjustment(s) that have been allocated to a code that no longer exists.

- Log into the prior year and go to Year End (I&E) → Adjustments to view a list of adjustments entered. It may be that the amount matches to one adjustment entry.

- If not you may need to review each adjustment to check the code still exists in the current year. To do this you may want to print the adjustments report so that you can compare to the cost codes appearing under Setup → Costs codes in the current year. If you are aware that you have made changes/deleted some codes you can check these first.

- Once you have identified the codes that no longer exist in the current year the adjustments allocated to those codes in the prior year will total the difference on the Trial Balance report.

How do I resolve the error?

The adjustments in the prior year need to be allocated to a code that exists in the current year. There are therefore two options:

- Add the missing cost code(s) back into the current year. Go to Setup → Cost Codes to do this ensuring that you amend the Cost Code Number to be the same as the code in the prior year. Log into the prior year and repeat the Close Accounts process to copy over the data again so it can update against the reinstated code(s).

- Update the prior year adjustments to be allocated to a code that still exists in the current year. To do this log into the prior year and re-open it. Go to Year End (I&E) → Adjustments and amend the relevant adjustments to a code that exists in both years. Run Calculate to update the balances and Close and copy over the YE data again (Year End (I&E) → Close Accounts).

When you have done the preferred option run the Trial Balance to check that it now balances.

0 of 0 found this article helpful.