Last edited:

VAT/Code Corrections for Payments or Receipts: Introduction

This option exists to correct an error on the cost code or VAT on an existing transaction record. The process will create one new record to negate the original one and another record to act as the replacement. You will therefore end up with three records, all of which will be cross referenced. The first two will balance out and you will no longer be able to edit them in any way. The third entry as the replacement is the same as any other first time entry, so can be changed again later if necessary.

How to Correct a VAT/Code in Scribe Accounts

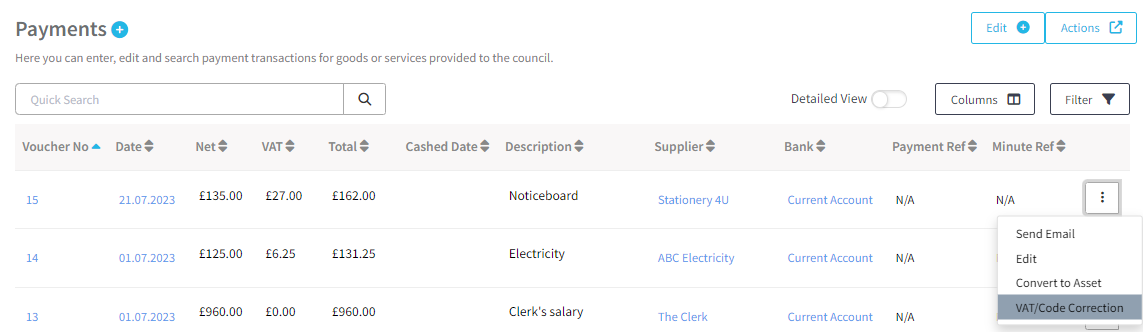

Navigate to Transactions → Receipts or Transactions → Payments. Find the entry you want to correct (use the search box if necessary to filter the records), click on the three dots to the right of the record and choose ‘VAT/Code Correction’:

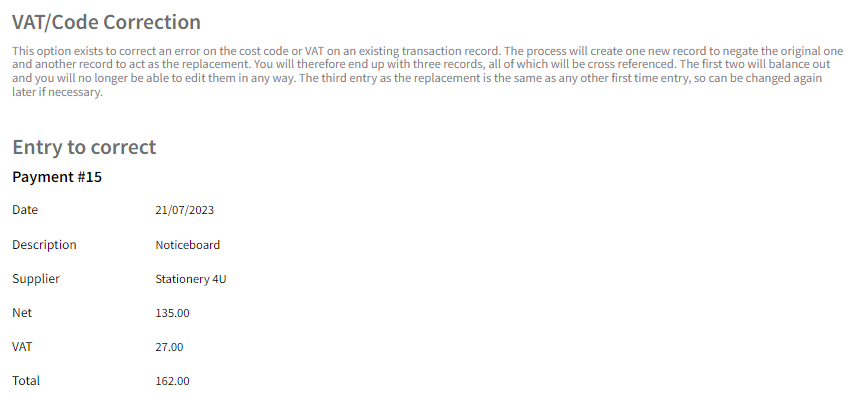

Once selected the VAT/Code Correction screen will be shown. The top entry will be a summary of the transaction you are going to correct:

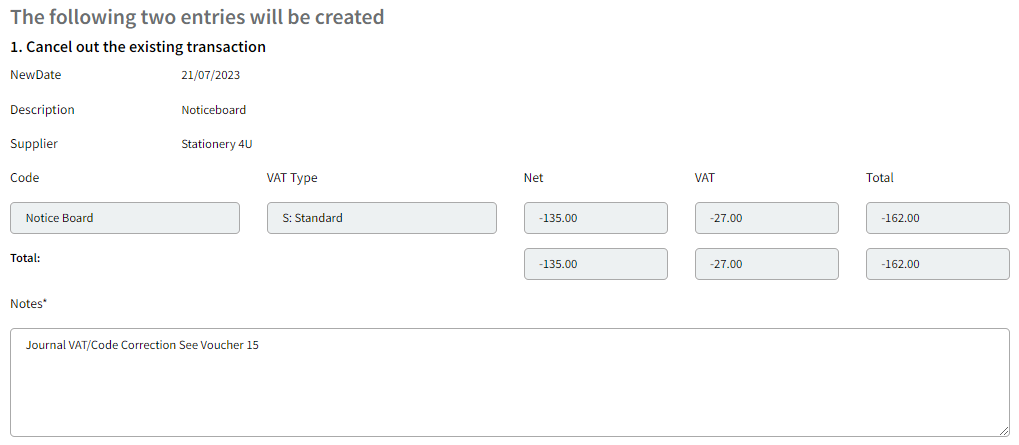

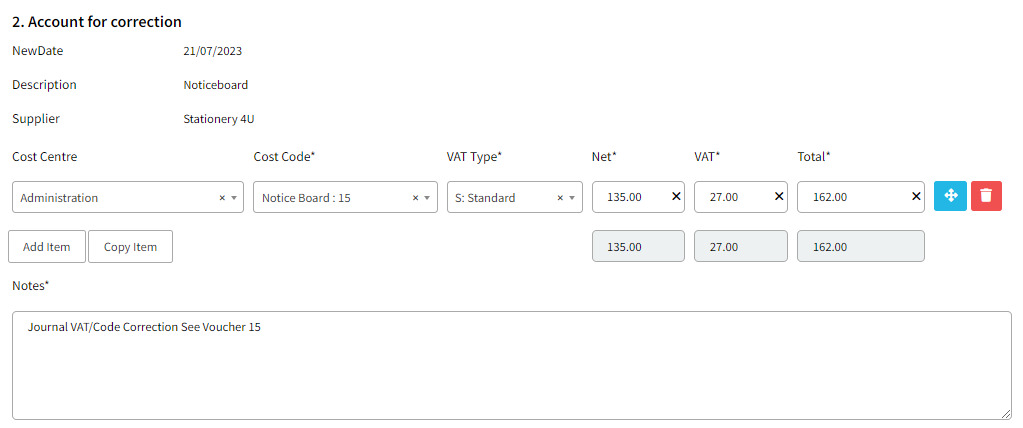

The two entries shown beneath it will be:

- The transaction to cancel out the original which cannot be edited and

- The replacement entry that will allow amendment:

Make the necessary correction to the correcting journal - amend the code and/or VAT type/amount.

You can add to the Notes if you wish to include more information, but do not remove the cross reference as this is important for your audit trail.

When finished, click on Save (you must confirm with Save so that the journal entries which you have created will be recorded, so do not just exit this screen because it appears to be correct). When saved, the original and cancelling entries will no longer be editable.

Note that the latest date which will be applied to a journal entry is 31 March. This is true even if you are entering journals as part of the year end, and you may be doing this in say April or May. The automatic date used for the JE entries will then be 31 March so that they do not interfere with the year end calculations. This is particularly important for VAT changes, and you must ensure that all journals or other changes to VAT at the year end are done before you make the relevant VAT return for the period ending 31 March.

0 of 0 found this article helpful.