Bank Balances - An Introduction

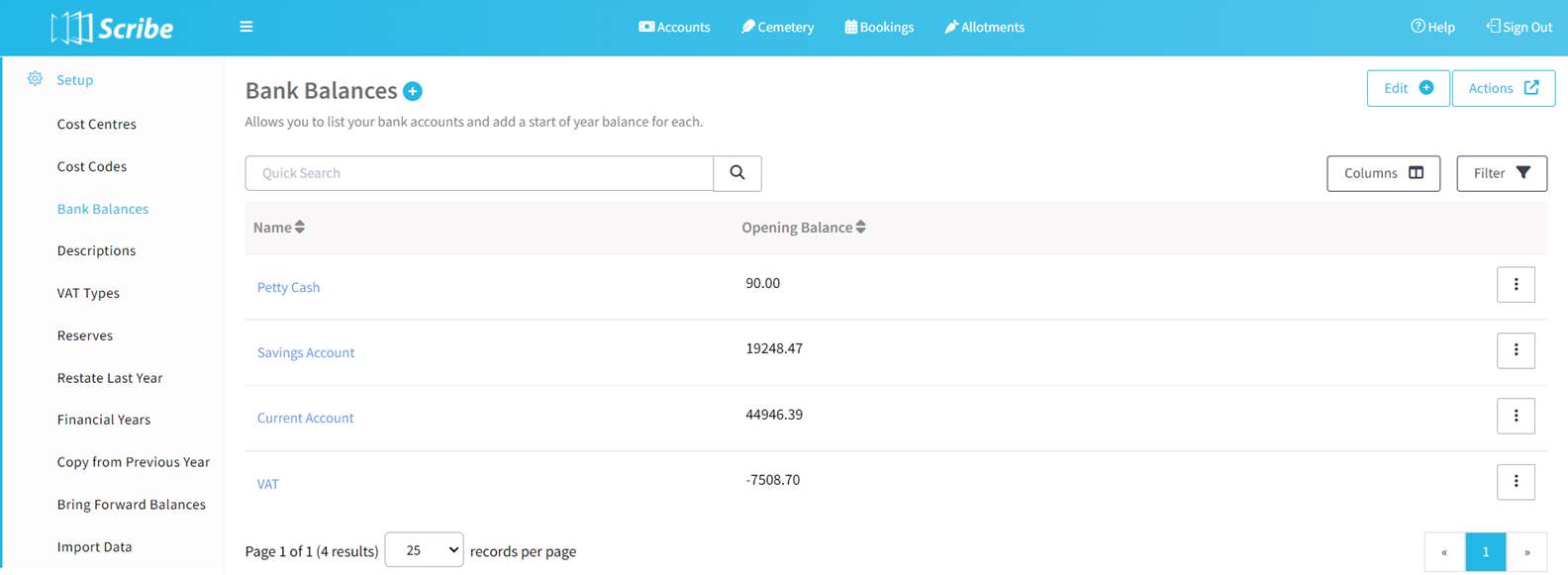

The Bank Balances feature in Scribe Accounts allows you to manage your bank accounts and their opening balances as of 1st April. Additionally, you will find a default Petty Cash account and a VAT account preconfigured within the system.

How to Add a Bank Balance in Scribe Accounts

To add a bank balance in Scribe Accounts, follow these steps:

- Navigate to menu Setup → Bank Balances.

- Click the "+" icon to add a new bank account.

- Enter the name of your bank account.

- Input the opening balance as of 1st April (refer to the guidance on opening balances below).

- Save your changes.

If Petty Cash is used, click on the name and this will take you in to edit the opening balance. Enter the cash balance as at 1st April. If not used, leave at £0.00.

The total of your opening balances as at 1st April must come from your cashbook, not your bank statements, as any unpresented items will need to be accounted for. A bank reconciliation as at 31st March will provide you with the figures required.

Once entered, add the opening balances of each bank (and petty cash if used) - this should equal the Box 8 figure on your previous annual return. Of course, the figures on the AGAR will be rounded, but this will provide you with confirmation that the opening balances are correct.

*If you set up a new bank account during the year, add it in here as a new account with a starting balance of zero. You will probably arrange to transfer funds into it, which should then be recorded as a Bank Transfer between the relevant bank accounts.

Entering the Opening VAT Position

The VAT account here is not a bank account, but allows you to show your opening VAT position as at 1st April - click on the name which will then allow you to enter this figure. This will be the amount that was due to be claimed, or was claimed but not received as at 31st March. Enter this balance with a minus to show the amount is owed back to you.*

*If you are VAT registered and in a position where you owe VAT, enter the outstanding amount to be paid to HMRC as at 1st April. This will be a positive figure.

See also the help notes on Initial Setup for New Users R & P

Initial Setup for New Users I & E

How to Edit Bank Balances

How to Edit Bank Balances

If you need to edit a bank balance, here's what you should do:

- Navigate to menu Setup → Bank Balances.

- Locate the bank balance you want to edit.

- Click the 3 dots next to the balance and choose "Edit" from the drop-down menu.

- Make the necessary amendments to the balance.

- Save your changes.

How to Delete a Bank Balance

To remove a bank balance from Scribe Accounts, follow these steps:

- Navigate to menu Setup → Bank Balances.

- Locate the bank balance you wish to delete.

- Click the 3 dots next to the balance and choose "Delete" from the drop-down menu.

How to Find Bank Balances

If you need to locate specific bank balances, use the following steps:

- Navigate to menu Setup → Bank Balances.

- If needed, utilise the provided quick search and filter options to refine your search.

2 of 2 found this article helpful.