What is the Purpose of the VAT 126 Report

The purpose of the VAT 126 Report for parish and town councils is to assist in reclaiming purchase tax on expenditure for non-business activity when the council is not registered for VAT. Typically, the prescribed VAT Form 126 is used, which requires a Schedule detailing the transactions to accompany it. This report helps to produce the schedule, which can then be attached as page 2 of the return. The VAT 126 Report includes any payment transaction with a VAT component. To provide the most comprehensive information, it is essential to capture suppliers' details, including their VAT registration numbers and invoice dates, using the Supplier options under the Setup menu.

How to Generate a VAT 126 Report

Log into Scribe Accounts and navigate to the menu VAT → VAT 126 Report. The report will be generated showing all payment transactions with a VAT component for the year so far.

How to Filter a VAT 126 Report

Click Filter on the right hand side above the report screen to view the available filter options:

- From / To: enter the date range for which you would like the report to run (ensure you only claim for complete calendar months).

- VAT: defaults to All but alternatively select a specific VAT type.

How to Download or Share the VAT 126 Report

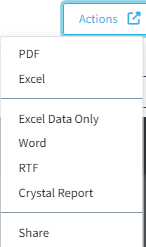

The report can be downloaded by simply clicking 'Actions' in the top corner of the screen. The following download options will be listed, PDF or Excel being the most commonly used. Click your chosen option and the report will be created.

Clicking Share will create a link that when clicked opens the report PDF in a separate webpage.

How to Print the VAT 126 Report

Generate the VAT 126 Report as described in the first section. Once the report is generated, click the printer icon in the top right corner of the report page. Follow the prompts in the print dialogue box to adjust settings and print the report.

3 of 3 found this article helpful.