How do I enter a supplier VAT registration number?

If the supplier has not yet been added

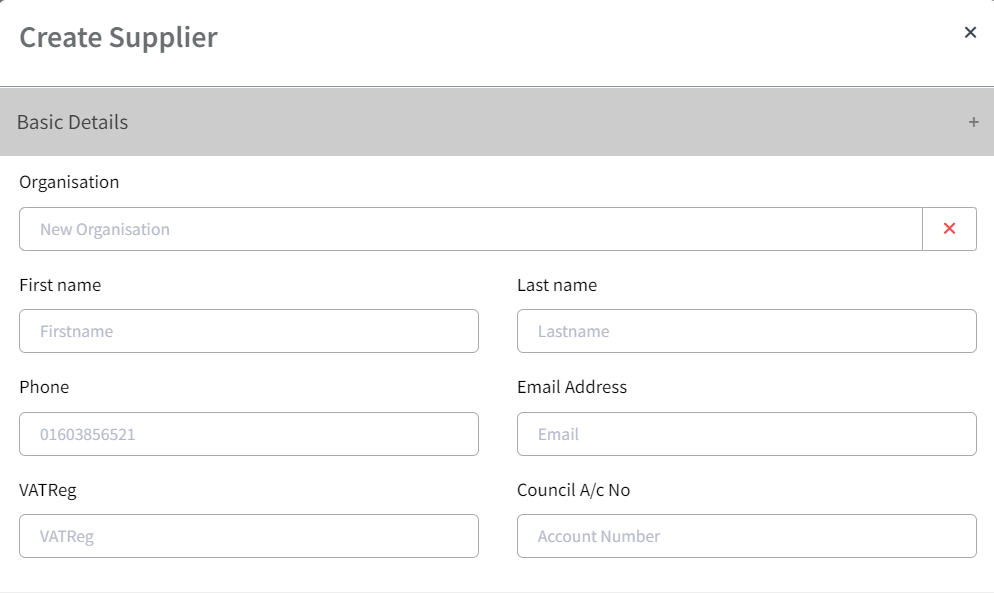

If your supplier contact record has not yet been created, then you can add the VAT registration number directly when setting them up or adding a transaction.

The simplest way to do this is by selecting the '+' icon next to the 'Supplier' field when adding a transaction. Here you can enter the VAT registration number directly in the 'VATReg' field whilst entering other details. This will ensure that the VAT number is stored against the contact and appears against VAT transactions on your VAT Form 126.

If the supplier already exists

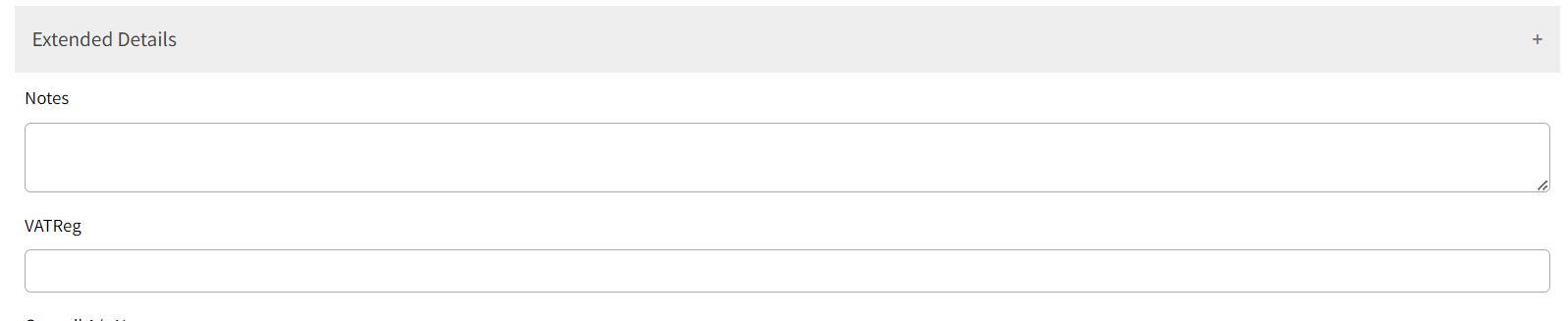

If the supplier already exists in the accounts (due to being created or allocated to a payment) but the VAT registration number has not been inputted, you can navigate to CRM -> Suppliers. Use the Quick Search or Filter to search for the supplier, then select the three dots and 'Edit'. Scroll down to the Extended Details section, enter the VAT registration in the 'VATReg' field and Save to update.

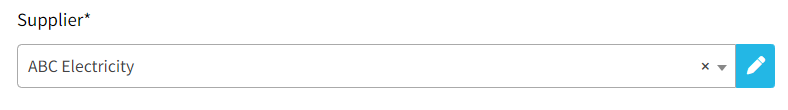

Alternatively, if you are adding a payment and have selected the existing supplier from the drop-down, you can simply select the pencil icon and add the VAT number here.

Repeat these steps for each supplier whose VAT number you want to add. For non-VAT registered Councils claiming back VAT using Form 126, this will ensure that the supplier VAT registration number appears.

0 of 0 found this article helpful.